The Illinois State Senate has passed a $53 billion spending plan, marking the largest budget in the state’s history. This significant financial decision awaits approval from the House.

The budget has sparked mixed reactions, with Democrats praising its fiscal responsibility and Republicans criticizing the record government spending.

Key Details of the Budget

Fiscal Responsibility and Record Spending

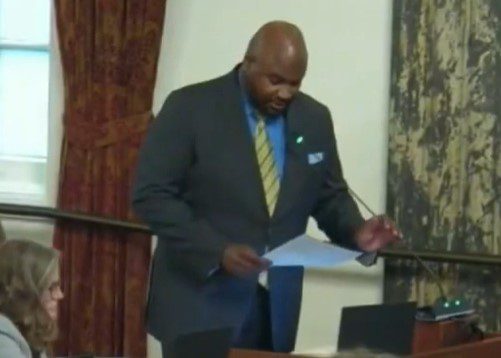

The budget has been hailed by Democrats as fiscally responsible and balanced. Senator Sims from Chicago, the lead negotiator, emphasized that the plan aligns with much of Governor Pritzker’s wish list while increasing spending in several critical areas.

However, Republicans have pointed out that this budget represents a 30% increase in spending since Governor Pritzker took office and criticized it for failing to balance the state’s finances.

Major Inclusions in the Budget

- Child Tax Credit: The budget includes an expanded child tax credit, which will grow next year, providing additional financial support to families.

- Local Infrastructure Investments: Significant investments are planned for local infrastructure, aiming to improve the state’s roads, bridges, and public facilities.

- Grocery Tax Repeal: The budget proposes the repeal of the grocery tax starting in January 2026, which is expected to reduce the financial burden on consumers.

Impact on Taxpayers

The budget’s failure to balance will result in tax hikes for Illinois residents. Critics argue that the increased spending without balancing the budget will place a heavier financial load on taxpayers.

Support and Opposition

Democratic Support

Democrats have largely supported the budget, highlighting its investments in essential services and infrastructure. Senator Sims expressed confidence that the House budgeteers would get the budget across the finish line, reflecting strong party support.

Republican Opposition

Republicans have voiced significant opposition, focusing on the budget’s inability to balance and the tax increases it will impose.

They also criticized the allocation of $182 million to provide services, including free healthcare and housing, to new arrivals and noncitizens in the state.

Future Steps

The budget now awaits approval from the Illinois House of Representatives. House Speaker Chris Welch has expressed optimism about the budget’s prospects, indicating a collaborative effort to finalize the financial plan.

Conclusion

The Illinois State Senate’s approval of the $53 billion spending plan marks a historic moment for the state.

While it promises significant investments in child tax credits, local infrastructure, and tax relief, the budget’s failure to balance and the impending tax hikes pose challenges.

The decision now rests with the House, where further discussions will shape the final outcome.