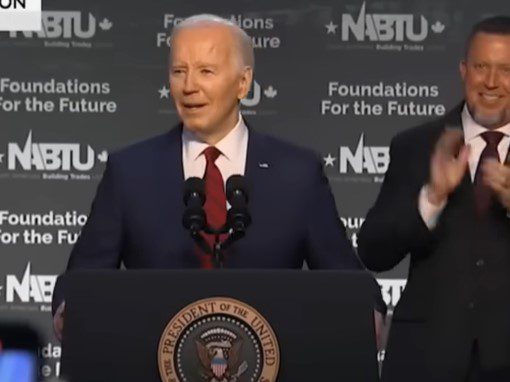

The Biden administration has faced significant criticism for its economic policies.

This blog post delves into key points raised by economic advisors and political analysts, examining the impacts of current policies on the American economy.

Overview of Biden’s Economic Policies

The Biden administration’s economic approach has been characterized by increased spending, inflationary pressures, and rising interest rates. Critics argue that these policies have created a challenging economic environment for many Americans.

High spending and inflation have been central issues, with opponents labeling the administration’s efforts as economically detrimental.

Perceptions and Reactions

Former President Bill Clinton suggested that the Biden campaign should adopt a more aggressive stance against Donald Trump, positioning him as a threat to the middle class.

This strategy, however, has not diverted attention from the economic challenges faced by the administration. Critics claim that the focus on Trump detracts from addressing the economic pain caused by current policies.

Impact on Financial Markets

Economic advisor Kevin Hassett highlighted concerns about the administration’s approach to the financial markets. He criticized the White House for allegedly provoking instability rather than ensuring market stability.

According to Hassett, the administration’s actions have the potential to trigger significant disruptions in global markets, especially in response to judicial outcomes involving Donald Trump.

Tax Policy and Its Implications

The debate over Trump’s tax cuts has intensified, with the Biden administration advocating for higher taxes on the wealthy. The Joint Committee on Taxation reveals that the top 1% already pay a substantial share of taxes, averaging around 30%.

This figure is significantly higher than the combined rate for the bottom 80% of Americans. Critics argue that increasing taxes on the wealthy could stifle economic growth and further harm the economy.

Economic Literacy and Partisanship

Hassett accused the administration of economic illiteracy and partisanship. He argued that the current policies prioritize political gains over economic stability.

The approach of raising marginal tax rates, despite having one of the most progressive tax systems globally, is seen as a move that could reduce economic growth. Countries like Sweden and France, known for their progressive tax systems, have lower marginal tax rates compared to the United States.

Middle-Class Tax Cuts

A significant portion of the Trump tax cuts benefited the middle class, with two-thirds of American households experiencing tax reductions.

The Biden administration initially proposed reversing these cuts but faced backlash for potentially harming middle-class Americans. This led to a revised stance, focusing on reversing tax cuts for millionaires and billionaires only.

Revenue Increases Post-Tax Cuts

Despite criticism, the Trump tax cuts have been associated with revenue increases. Since their implementation, revenues have risen by about 10% relative to forecasts from 2019.

This suggests that the tax cuts had a stimulative effect on the economy, challenging the narrative that they primarily benefited the wealthy at the expense of broader economic health.

Conclusion

The economic policies of the Biden administration continue to spark debate and criticism. From increased spending and inflation to contentious tax policies, the impacts on the American economy are significant.

Understanding these dynamics is crucial for assessing the current and future economic landscape.